Car Import to the Canary Islands

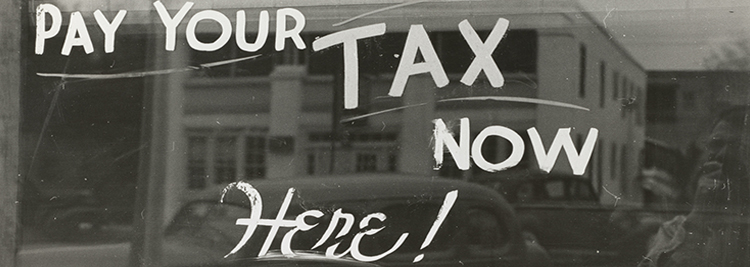

Importing a car to the Canary Islands is not a business anymore as the Canarian authorities have implemented various taxes which makes it only interesting to import vehicles which are rare to find on the islands. We imported in 2018 a BMW 7 because of its black color and the beige leather interior.

Her it goes: Normally you should know that in the country of origin you must pay a cost. Initially the expenses you must pay would be:

• Vehicle price

• Transfer costs (only if you buy from an individual; as in Spain, if you buy from a dealer or professional sale it is usually all included in the purchase price).

• Travel expenses to see and evaluate the car

• Accommodation in the country of origin

• Provisional license plates (only if you are going to take the car yourself driving it to the destination). Like everything in life, prices, and conditions of purchase in the country of origin are negotiable. You can negotiate the price and / or include services such as documentation, temporary registration, etc. You should know that, if you buy from a dealer or a professional sale, always require an invoice where the seller's intra-community VAT number appears.

Customs and clearance

CAR TRANSPORT TO THE CANARY ISLANDS

• Bring the car yourself driving it: you need temporary license plates that allow you to circulate in any country of the European Union and have associated insurance to third parties. Its price depends on range from ninety € to 250 €.

• Bring you the car with a transport company: one or several. This includes a crane (cheap option) or container (expensive option) for land transport, and a ro-ro type transport (cheap option) or closed container (expensive option) for maritime transport.

To authorize entry into the Canary Islands, it is necessary for a Customs official to authorize and review the documentation to embark the vehicle and settle the IGIC.

Once the vehicle is cleared and the DUA (single customs document) and the release document for export are issued, the car is ready to board. It is important that, from now on, you carry a copy of the DUA for all the procedures because you will need it.

IGIC

The general rate of the current IGIC is 7%, but for motor vehicles there is a special rate with two sections:

• For less than 11 fiscal horses: 9.5%

• For more than eleven fiscal horses: 13.5%

In Spain, the fiscal horses (CVF) come in the technical sheet. The IGIC is the first payment to make, it is necessary to remove the car from theboat. Usually, the same company that brings you the car by boat helps you cancel (pay) the IGIC in Customs through the model 032.

The Canarian Tax Agency manages tables with the tax values of the different cars. It will depend on the model, engine, finish, and age of the vehicle.

ITV and more taxes

IMPORT ITV (only if the car does not have ITV in force)

Since May 20, 2018, the COMMUNITY regulation UNE EN/ISO 17020 applies, by which if the car has the ITV in force in the country of origin it is not necessary to pass it again in Spain.

The COC (certificate of conformity), is an official document issued by the brand where all the technical data of the vehicle appear. When it comes to passing the ITV to homologate our imported car, the COC will be used as a guide, and everything will be easier, faster, and cheaper.

PROPERTY TRANSFER TAX (ITP)

To register it, you will have to present form 620 to the Canarian Tax Agency to be validated that it is an operation subject only to IGIC and that you do not have to pay ITP.

MUNICIPAL CIRCULATION TAX

This tax is annual and the price to pay depends on your town hall and the fiscal horses of the vehicle.

REGISTRATION TAX

The registration tax is paid according to the CO2 emissions that are recorded in the technical sheet.

TUITION FEES

We have already reached the penultimate step... at last! This is the moment when the Traffic Headquarters of your island assigns you a registration number for a modest fee of € 95.80.

To be able to register your vehicle in Traffic:

• DNI

• ITV card

• DUA

• Proof of payment of the circulation tax of your town hall (IVTM)

• Proof of payment of registration tax (form 576)

• Original documentation of the vehicle (which they keep forever)

• Proof of purchase

• Registration application form

REGISTRATION

Last step. Find a place where they make license plates, put them in the car and enjoy it.